US nuclear plants face widening uranium supply gap, EIA warns

US nuclear utilities face possible uranium shortages over the next decade, the Energy Information Administration warned, underscoring supply chain challenges in the world’s biggest atomic-power market.

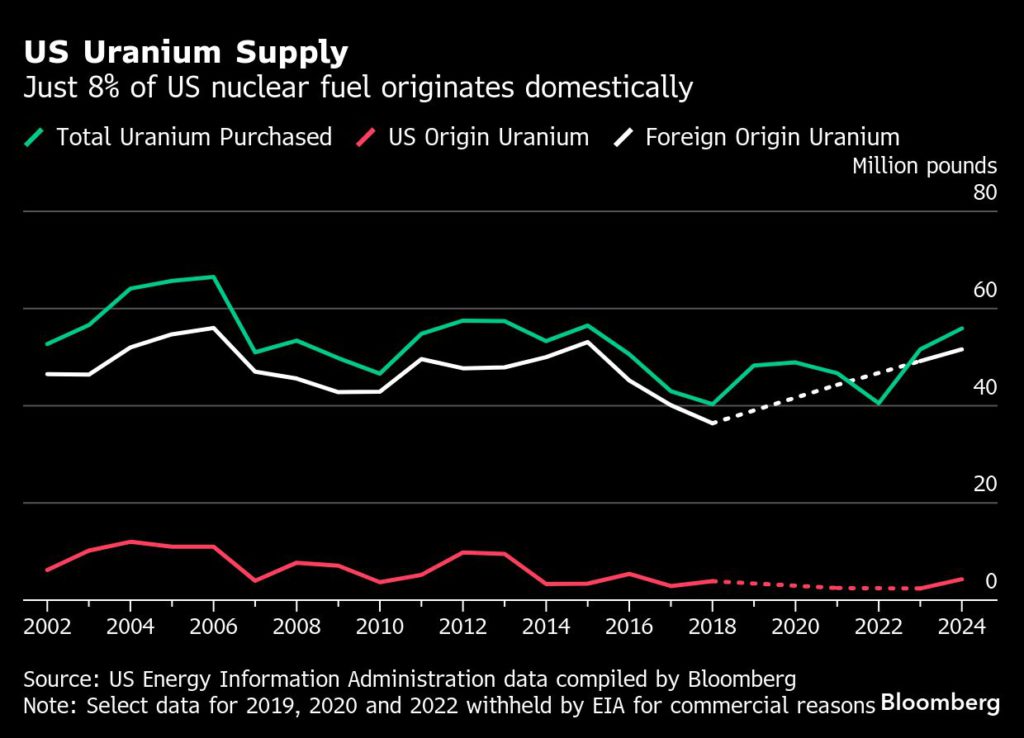

Utilities signed fewer contracts for delivery last year as uranium prices surged, a report by the US agency said. High costs are pushing them to delay decisions to cover future fuel requirements, even though less than a tenth of the uranium delivered to US reactors is typically bought on spot markets.

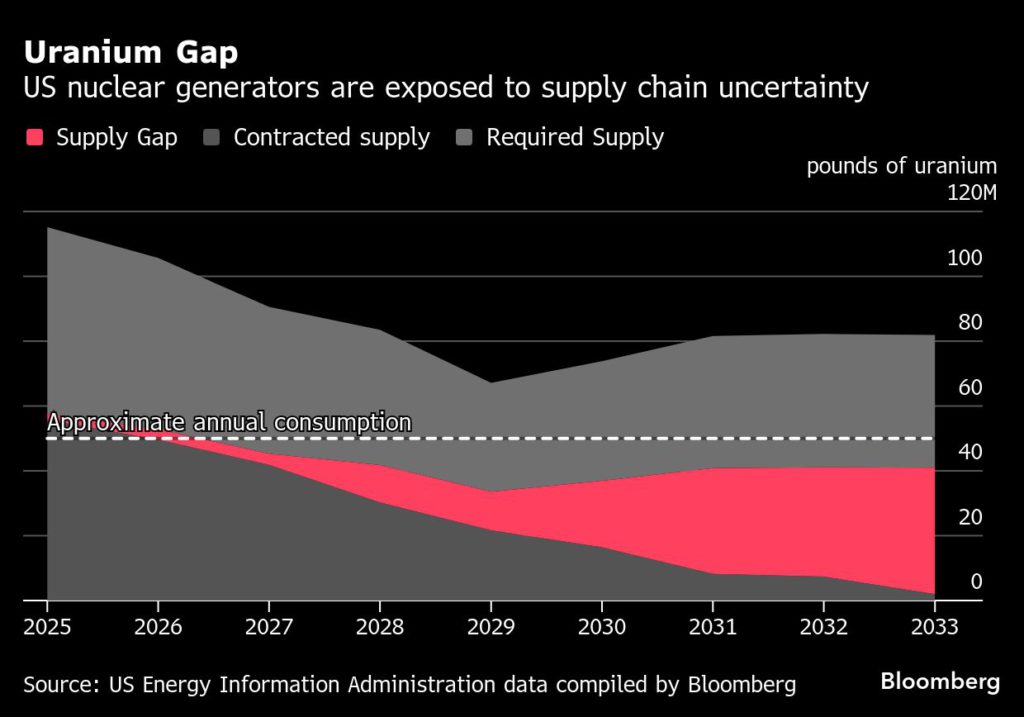

The uranium supply gap is expected to widen over the next decade to a combined 184 million pounds — equivalent to more than three years of consumption. In the absence of long-term supply deals, the EIA report suggests more utilities may need to forge shorter-term arrangements to keep reactors operating.

While Silicon Valley investors pour billions of dollars into designing nuclear reactors, the EIA report suggests continued US vulnerability in fuel supply. More than 90% of the uranium consumed by US reactors last year was sourced internationally.

Russia remained the top supplier of nuclear reactor fuel to the US last year, even after a ban on enriched uranium imports from the country took effect in May.

“We’re moving to a place — and we’re not there yet — to no longer use Russian enriched uranium,” US Energy Secretary Wright told Bloomberg News last month, suggesting the US needs to build a bigger uranium buffer.

In 2024, the Biden administration signed into law legislation that requires utilities to shift away from Russian supplies by 2028. Six months later, Russia retaliated by temporarily limiting exports of enriched uranium to the US. The White House issued an executive order in May that’s intended to accelerate the deployment of advanced reactors and fuel.

This year’s EIA report, which tracks global uranium shipments to and from the US, was delayed because of sweeping staff cuts imposed by the Trump administration. The independent energy department unit lost more than 100 of its roughly 350-person workforce amid buyouts and other streamlining efforts spearheaded by the government-efficiency push formerly led by Elon Musk.

(By Jonathan Tirone)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments