US premiums for silver and palladium are underpriced, Citi says

The gap between palladium and silver prices in the US and international benchmarks is too slim, given the risk of tariffs on critical minerals, Citigroup Inc analysts said.

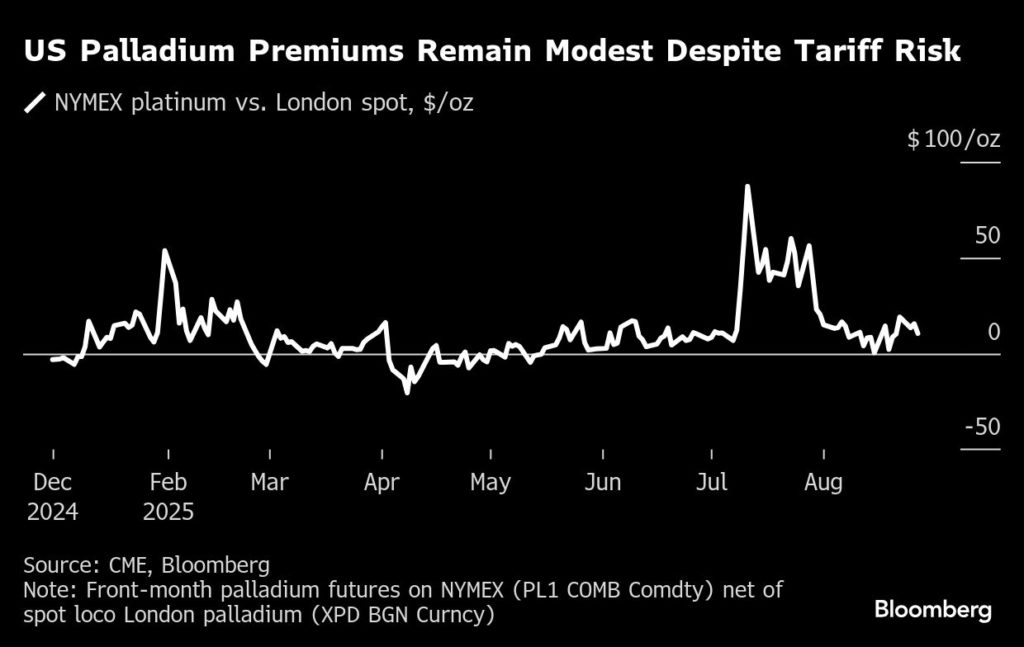

US futures prices for all precious metals soared above benchmark London spot prices earlier this year as traders anticipated the imposition of levies on imports. From copper to gold, the volatility in futures generated bumper profits for traders who could anticipate US trade policy and heavy losses for those who couldn’t.

When the forms of palladium, platinum and silver that are used on the COMEX futures exchange were formally exempted in April, those spreads collapsed.

But US premiums for palladium and silver are now “underpricing US tariff risk, currently at just a 2-3% premium to ex-US pricing,” analysts, including Tom Mulqueen, wrote in a note Wednesday.

Silver was added Monday to a list of 54 critical minerals for which the US is dependent on imports, pending the outcome of a review under Section 232 of the Trade Expansion Act, which allows for the imposition of tariffs on goods deemed vital to national security.

Citi sees targeted tariffs, either immediate or phased, of as much as 50% on some metals on the list by the time the Section 232 report is published in October.

“We expect the degree of potential to quickly develop and grow domestic production capacity (and any pro-tariff industry lobbying to this effect) may inform a differentiated approach by metal/mineral,” the analysts said.

The US Commerce Department also started an anti-dumping investigation of unwrought palladium from Russia earlier this month. Citi’s base case is that the precious metal used in catalytic converters will be hit with tariffs either through this probe or the Section 232 report.

(By Jack Ryan)

More News

Contract worker dies at Rio Tinto mine in Guinea

Last August, a contract worker died in an incident at the same mine.

February 15, 2026 | 09:20 am

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments