Voluntary carbon markets: Here to stay?

How can the world accelerate down a net zero pathway when some emissions can’t be abated by current technology? For some companies in hard-to-abate industries, carbon offsets can provide a practical pathway to carbon neutrality, at least while necessary abatement solutions are developed.

What is carbon offsetting?

The concept of carbon offsetting was introduced as part of the Kyoto Protocol in 1997. In broad terms, carbon markets connect entities that generate carbon emissions with entities that have a surplus of carbon reduction. An emitting company can offset a tonne of carbon emissions by acquiring an equivalent credit created by a low-carbon project.

Why is this necessary? Energy-intensive industries (such as oil and gas, aviation, metals and mining, and cement) can be tough, or even impossible, to fully decarbonise with current technologies. Metals and mining, in particular, poses something of a paradox as the industry is tasked with meeting booming demand for raw materials that are vital to the energy transition, while simultaneously cutting emissions.

These industries need practical instruments to compensate for residual emissions while long-term solutions evolve.

The system is not without its critics. Some see offsets as a greenwashing tactic that can be used in place of real carbon mitigation solutions. In our view, offsets can work effectively as a tool in the decarbonisation toolbox, but it is true that high emitters cannot simply trade their way to a lower carbon future. Oil and gas companies, for example, have important roles to play both as buyers of carbon offsets in the voluntary carbon market, and as developers of carbon avoidance and sequestration projects.

What is the voluntary carbon market?

There are two types of markets where carbon is traded as a commodity:

In compliance-based carbon markets, companies are obligated to buy allowances for emissions above a certain mandated threshold. (This is primarily ‘cap-and-trade’; carbon taxes are another type of mandatory instrument, but they don’t establish a carbon market).

The voluntary carbon market trades carbon offsets on an optional basis. It connects suppliers with buyers through market intermediaries and allows companies to meet self-imposed net zero targets. While compliance markets tend to cover Scope 1 emissions, voluntary markets can meet demand for emissions compensation along the value chain.

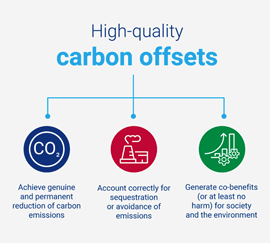

Carbon offset projects fall into two broad categories: removal and avoidance. They range in size from very small (for example, micro-grid solar panels) to large, industrial installations (such as carbon capture and storage associated with a coal-fired power plant).

Third-party auditors assess the amount of emissions reduction or avoidance a project can deliver and issue a corresponding number of tradeable offsets that can be sold on the voluntary carbon market.

What do carbon offsets cost?

Voluntary carbon markets traded around 300 million tonnes of emissions in 2021, for a value of $1 billion. This represents around 0.8% of global GHG emissions. The average price for offsets traded is currently around $5/tonne of carbon.

This price is unsustainably low. Why? Carbon markets are a great concept, but in practice have been beset by inconsistencies. Too many credits were created, often from poor quality projects. As confidence in the market ebbed, prices sank.

At COP26, nearly 200 countries came together to agree the terms of Article 6 of the Paris Rulebook. This paved the way for an enhanced transparency framework with consistent accounting and reporting targets. It’s a gamechanger for the value of carbon offsets.

How will carbon markets evolve?

COP26 outcomes will continue to boost confidence in carbon offsets, but the Paris Rulebook didn’t directly establish a global carbon market. Each country will decide if, and how, to integrate carbon markets into national legislation, or whether to enter partnerships with other countries.

Our view is that COP26 outcomes will push more countries to establish national compliance carbon markets or other forms of carbon pricing; as well as further integrate offsetting into their compliance mechanisms. Over the next decade, we expect to see an evolution of markets at national and regional level. A truly global, integrated and cooperative market with a minimum carbon price could lie ahead.

However, we don’t expect compliance markets to replace their voluntary counterparts. Rather, the two will continue to exist in parallel for the foreseeable future and will both experience significant increases in prices and scope.

(By Elena Belletti, Head of Carbon – Energy Transition Practice and Rachel Schelble – Research Director, Corporate Research)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments