Zijin Gold soars 68% in HK debut after world’s top IPO since May

Zijin Gold International Co. jumped in its Hong Kong trading debut after the international unit of China’s biggest miner raised $3.2 billion in the world’s largest initial public offering since May.

The shares climbed 68% to close at HK$120.60 on Tuesday, boosting its valuation to HK$316.5 billion ($41 billion) and overtaking the likes of Chile-based Antofagasta Plc, one of the world’s biggest copper miners. It was the best opening day globally for an IPO of that size since 2021, according to data compiled by Bloomberg.

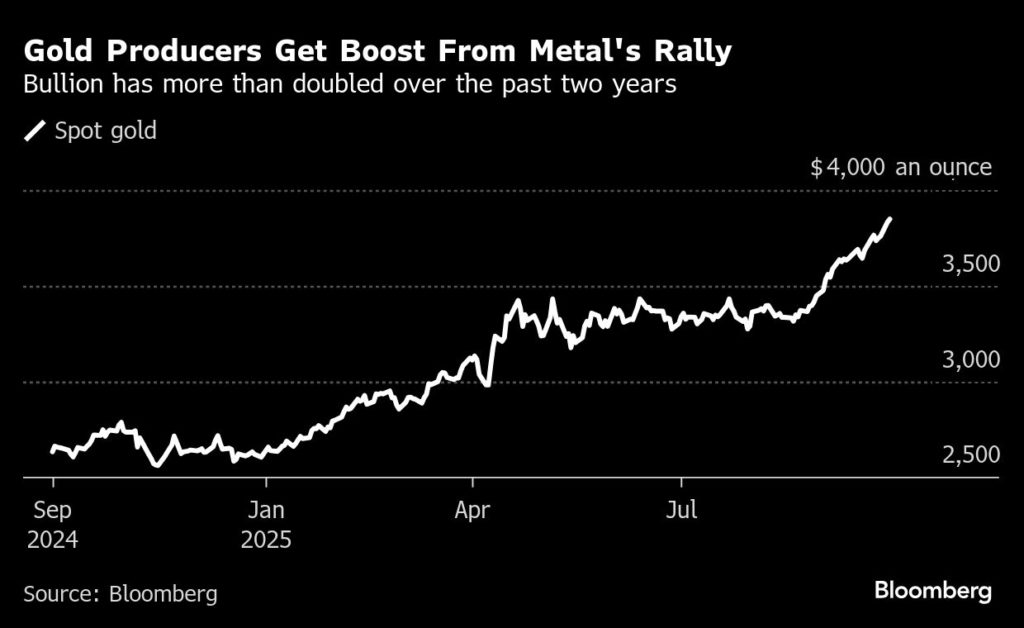

Zijin Gold came to market as optimism remains high for prices of the precious metal to extend their three-year, record-breaking bull run, bolstering miners’ shares and facilitating their ability to raise funds. It’s also a victory for Hong Kong, which now boasts being home to the world’s two biggest listings of the year, as IPO proceeds in the city head for a four-year high.

“Zijin Gold has definitely picked the best time to go IPO,” said Michelle Leung, an analyst at Bloomberg Intelligence. “The continuous surge in gold prices has driven up valuations across global gold miners.”

Prices of the yellow metal hit a fresh record of $3,871.72 on Tuesday before easing, and Leung said if the rally keeps going, it would give Zijin Gold’s valuation a further boost.

The prospect of buying into an undervalued blue-chip stock attracted a marquee list of cornerstone investors that included the likes of Singapore sovereign-wealth fund GIC Pte, Hillhouse Investment, BlackRock Inc., Fidelity International Ltd. and Millennium Management LLC. These buyers, which get IPO allocations in exchange for holding the stock for at least six months, agreed to buy about half of the shares on sale.

The company and its parent Zijin Mining Group Co. aren’t the only ones to have benefited from the rally in gold. PT Merdeka Gold Resources began trading in Jakarta this month after raising more than $280 million in Indonesia’s largest IPO this year, and Shandong Gold Mining Co. sold about $500 million of stock.

As for Zijin Gold, the company plans to use some of the IPO proceeds to pay for the acquisition of a mine in Kazakhstan, as well as funding upgrades and construction of mines over the next five years, it said.

“A sustained gold rally will give Zijin the firepower for aggressive global expansion and growth,” said Eugene Quah, partner at the Sydney-headquartered AFG Venture Group. “Savvy investors will want to see Zijin navigate the complex global environment with skill as it deploys this capital.”

The company, which operates Zijin Mining Group’s overseas gold assets, is one of the world’s fastest-growing gold producers, with mines spanning from Central Asia to Australia, Africa and South America.

The only company to have had a bigger listing this year was Contemporary Amperex Technology Co. Ltd.’s $5.3 billion mega deal, which was also in Hong Kong. After years of struggling through a drought of deals, the Asian financial hub is poised to see IPO proceeds surge to a four-year high of more than $26 billion, according to BI estimates.

The company’s trading debut, originally scheduled for Monday, was delayed by Super Typhoon Ragasa. Morgan Stanley and Citic Securities Co. were joint sponsors for the IPO.

(By Yihui Xie)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments