Zinc sees biggest squeeze in decades as LME inventories run dry

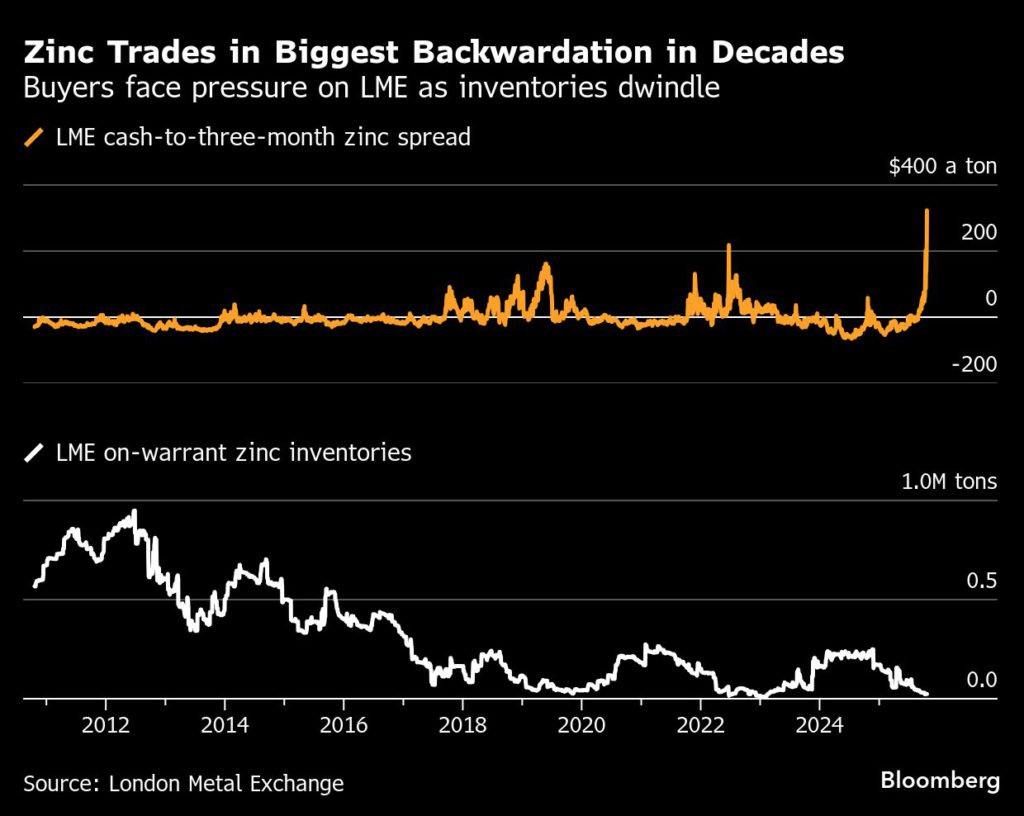

The London Metal Exchange zinc market is facing the most severe squeeze in decades as traders rush to get hold of a dwindling volume of inventory underpinning contracts on the bourse.

Spot zinc prices surged to trade $323 a ton above contracts expiring in three months, the highest spread since at least 1997. A premium for near-dated contracts is known as a backwardation, and it’s a hallmark sign that spot demand is exceeding supply.

The pressure on buyers has been building for months as inventories in the LME’s warehouse network have plunged towards record lows struck in 2023, as several western smelters have dialed back production following a collapse in processing margins. There are now just 24,425 tons of zinc available to buyers in LME warehouses — enough to service demand in the 14-million-ton global market for less than a day.

The spike in the cash-to-three-month zinc spread came shortly after data from the LME signaling that traders are rushing to secure the stock that’s left. There are six separate entities with long positions in LME inventories and contracts expiring within the next two days, with their combined positions entitling them to at least 300% of the stock that’s readily available in the LME warehousing system, the data showed.

On the other side of the trade, the backwardation could expose sellers to heavy losses if they don’t have metal to deliver against their contracts. The Tom/next zinc spread — which represents the price to roll positions forward by one day — hit $30 a ton on Tuesday, the highest level since a historic squeeze in 2022.

“LME warrant holdings reports shows some significant longs,” said Al Munro, senior base metals strategist at Marex. “The reality is the backwardations on the LME are yet to attract material and stock inflows.”

Meanwhile, Chinese smelters have maintained production, creating a wide gap between zinc prices on the LME and the Shanghai Futures Exchange. Some are planning rare exports to capitalize on the arbitrage, which may bring some short-term relief to buyers on the LME.

“Stocks are at a very low level and the physical market feels finely balanced outside of China,” said Duncan Hobbs, head of research at Concord Resources Ltd. “So it’s a market from that point of view that has looked vulnerable to what we’re seeing happen now.”

(By Mark Burton, Archie Hunter and Winnie Zhu)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments