CHARTS: US copper glut hides refining crunch

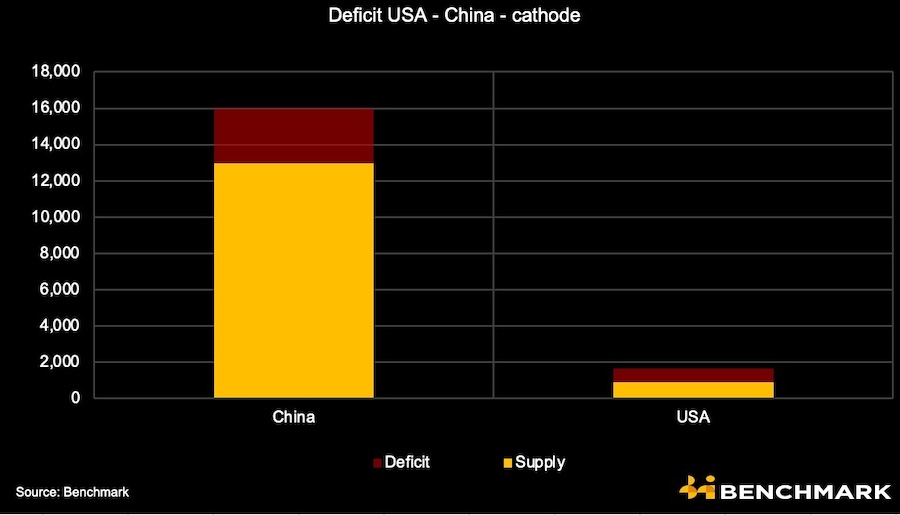

The US produces more raw copper than it consumes but lacks the processing capacity to turn it into usable metal, leaving manufacturers dependent on foreign refiners, a new report finds.

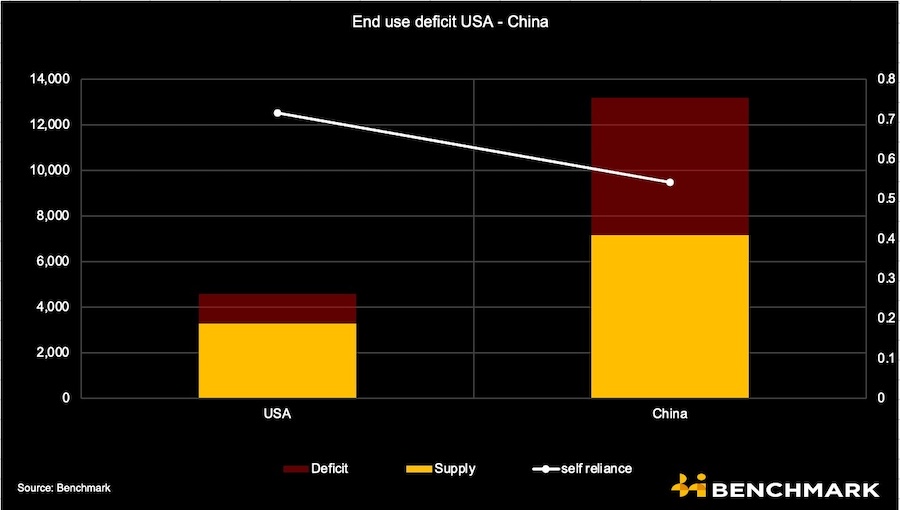

Benchmark Mineral Intelligence found the US can meet 146% of its domestic copper demand through a combination of mine output and scrap, compared with just 40% for China, the world’s largest consumer. Yet nearly 48% of US mined copper concentrate is exported, largely because of limited domestic smelting and refining capacity.

The US produced 1,714 kilotonnes of copper in 2024, but it still depends heavily on imported refined copper for industrial use. Domestic concentrate and scrap are often shipped overseas, frequently to China, for processing before copper cathode is exported back to US buyers.

“The US is producing more copper than it uses and is far more self-reliant than China in copper as a percentage. This is largely due to the huge amount of demand that China generates,” Benchmark copper analyst Albert Mackenzie told MINING.COM. He said China’s push into overseas assets reflects necessity as much as strategy.

The key constraint for the US is downstream processing capacity needed to convert concentrate into copper cathode, the refined metal manufacturers use. Benchmark’s analysis suggests expanding domestic refining capacity would strengthen supply security more effectively than acquiring additional raw material assets abroad.

“Both via scrap and domestic mining the US is more self-reliant. In fact, if you remove all US overseas mines, the US still is self-sufficient for raw materials,” Mackenzie said. “The problem is that the US doesn’t have the processing capacity. One could read from it that the US should increase scrap processing before focusing on overseas mine investment.”

Scrap already plays a significant role in US supply. Mackenzie said US semi-fabricators consume large volumes of domestic scrap in their production, and scrap could account for a greater share of demand if processing capacity expands.

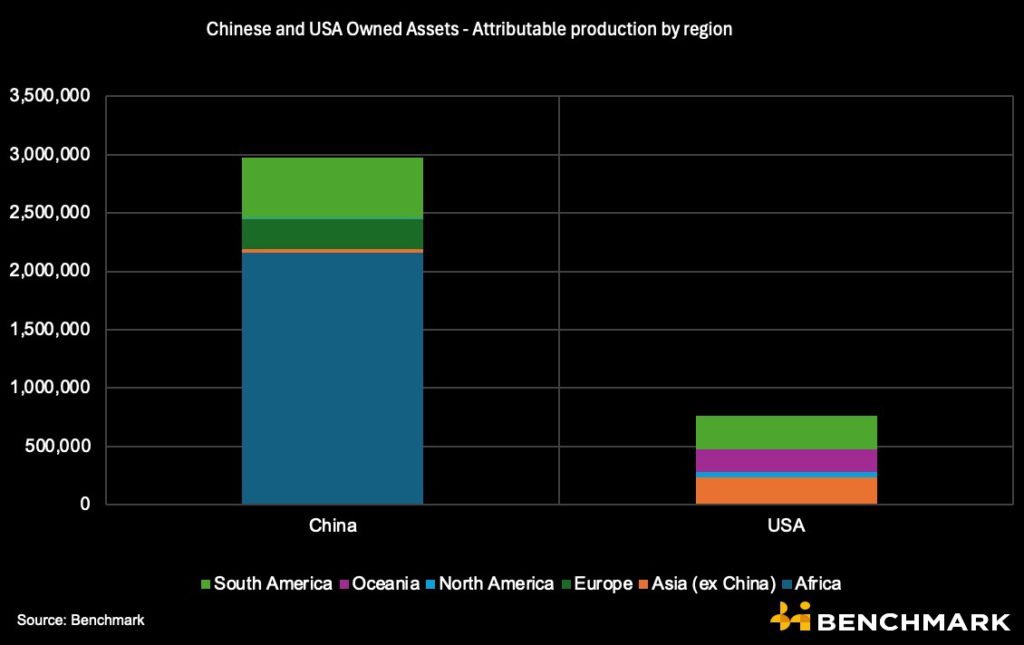

The findings challenge Washington’s efforts to secure additional upstream supply through initiatives such as Project Vault, which aims to expand stockpiles and boost US corporate ownership of mineral assets in countries including the Democratic Republic of Congo.

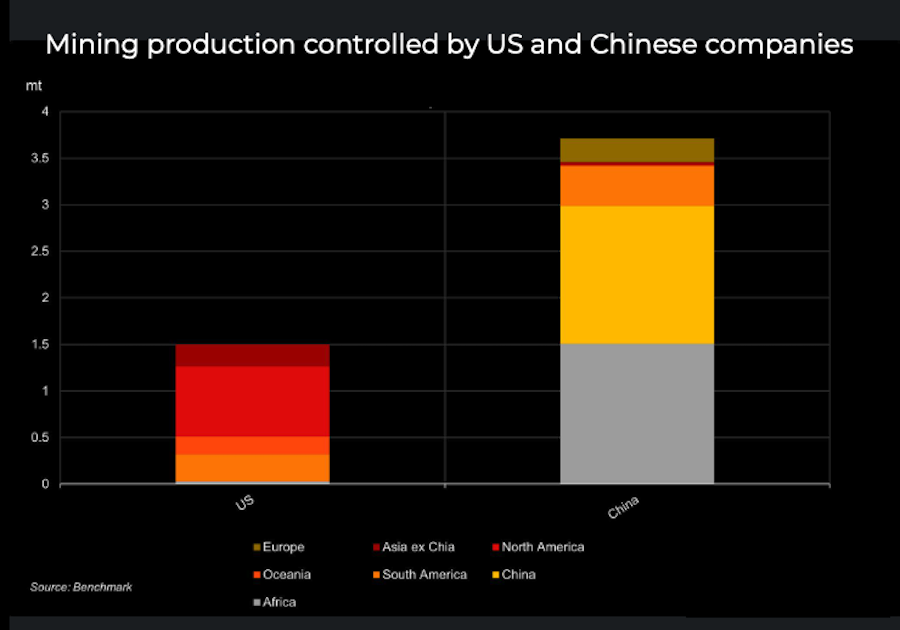

The report argues that limited US processing capacity means copper from US-owned mines abroad does not necessarily return home, while Chinese-owned overseas output more often flows back to Beijing.

China, often viewed as self-sufficient, consumes far more copper than it produces and relies heavily on imported raw materials. While US companies are seen as trailing China in overseas mine investment, they control a larger share of their raw material needs relative to domestic demand than Chinese firms do, according to Benchmark. However, given the volume China must import, Mackenzie said the country remains exposed to geopolitical risk despite its overseas investments.

“For China the biggest single factor is overseas resources,” he said. “A much higher percentage of Chinese overseas material heads back to China than does for the US. You could easily make the case that despite their investments overseas they are not free from geopolitical risk exposure.”

Over 60 new mines by 2030

Globally, Benchmark estimates 61 new copper mines will be needed by 2030 to meet rising demand, requiring about $285 billion in investment. London benchmark copper prices have climbed roughly 40% since October, hitting a record $14,000 earlier this year amid supply disruptions and concerns about looming shortages.

Benchmark’s outlook aligns with broader industry forecasts. BHP chief commercial officer Rag Udd said last year that global copper demand could rise 70% to 50 million tonnes annually by 2050, driven by copper’s role in existing and emerging technologies and by decarbonization goals.

The world’s largest miner expects the energy transition sector to account for 23% of copper demand by 2050, up from 7% today. Demand from the digital sector, including data centres, 5G and artificial intelligence, is projected to increase from 1% to 6%.

Beyond 2030, some research suggests that meeting net-zero emissions targets by 2050 could require dozens to nearly 200 new large copper mines globally, or roughly one to six new large mines each year through mid-century.

More News

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments