Ivanhoe in talks to send Congo zinc to US stockpile

Ivanhoe Mines (TSX: IVN) is in advanced talks with Congo’s state miner Gecamines and Swiss commodities trader Mercuria to route zinc-rich concentrate from its Kipushi mine to the United States under Washington’s newly launched strategic stockpiling scheme, Project Vault.

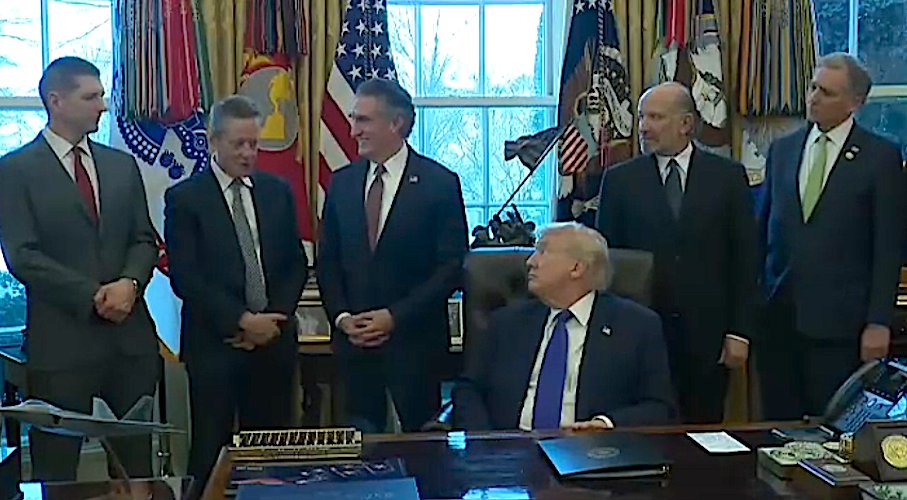

The discussions follow the White House launch of Project Vault, which Ivanhoe founder and co-executive chairman Robert Friedland attended. The $12 billion programme aims to secure long-term supplies of strategic metals, backed by $1.67 billion in private capital and a $10 billion loan facility from the US Export-Import Bank.

Momentum behind the plan is building in Washington. Senators are set to introduce legislation on Wednesday to reauthorize funding for the Export-Import Bank for another decade, with the goal of injecting an additional $70 billion into the agency to support Trump’s critical minerals agenda, the Financial Times reported.

Republican senator Kevin Cramer of North Dakota, who is co-sponsoring the bill with Democrat Mark Warner, told the FT that Trump was “all in” on backing Ex-Im and “sees the value” of the institution. Cramer said he would push to raise the bank’s lending cap to $205 billion from $135 billion as part of the package.

Behind the talks

Under the proposed arrangement, Mercuria would assign its existing offtake for Kipushi concentrate to Gecamines’ trading arm and market additional volumes expected once the mine ramps up later this year, Ivanhoe said. Gecamines could ultimately handle up to 50% of Kipushi’s output, including shipments destined for the US.

Gecamines confirmed the partnership in a separate statement on Tuesday, citing a December 2025 deal with Mercuria that provides financing and logistics to activate its offtake rights. The miner said the agreement marks the first step in a plan to expand into processing zinc, copper, germanium and gallium, with the long-term aim of becoming Kipushi’s sole buyer.

US-Congo ties

The talks form part of a broader US-Congo push on minerals as Washington intensifies competition with China for access to Africa’s vast resource base.

Glencore (LON: GLEN) and the US-backed Orion Critical Mineral Consortium announced this week a similar deal to channel cobalt and copper from the DRC into the US supply chain under the same government-supported programme, underscoring rising competition among Western buyers.

Kipushi, one of Congo’s largest polymetallic deposits, is forecast to produce 240,000 to 290,000 tonnes of zinc concentrate this year, including meaningful volumes of germanium and gallium, minerals the US classifies as critical for semiconductors, defence and clean-technology uses.

More News

Fidelity fund that sold gold before crash is ready to buy again

“If we see another 5%, 7% correction, I’m buying up,” says Fidelity manager George Efstathopoulos.

February 04, 2026 | 07:18 am

Vance says US will establish price floor system for critical minerals

February 04, 2026 | 07:02 am

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments