China lithium tumult spurs futures exchange to step in again

Lithium’s violent price swings have prompted China’s futures exchange to intervene once again to manage market risks.

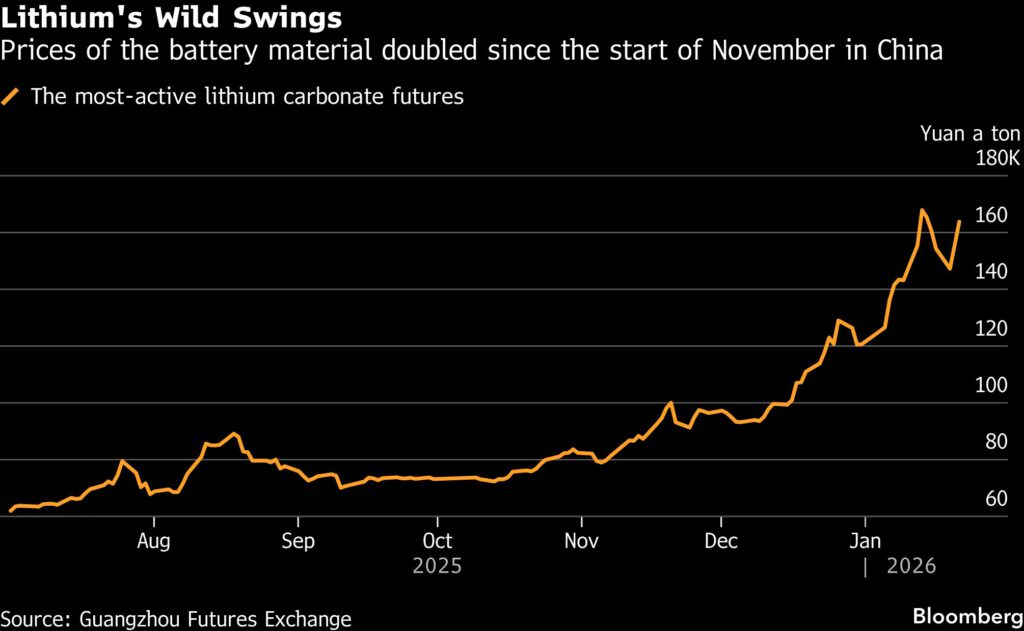

The lithium carbonate contract on the Guangzhou Futures Exchange closed limit-up on Tuesday. Futures have touched their daily limits — whether up or down — on several occasions this month. The bourse has responded to the volatility by allowing more leeway, widening the daily trading band to 11% from 9% as of Wednesday’s settlement.

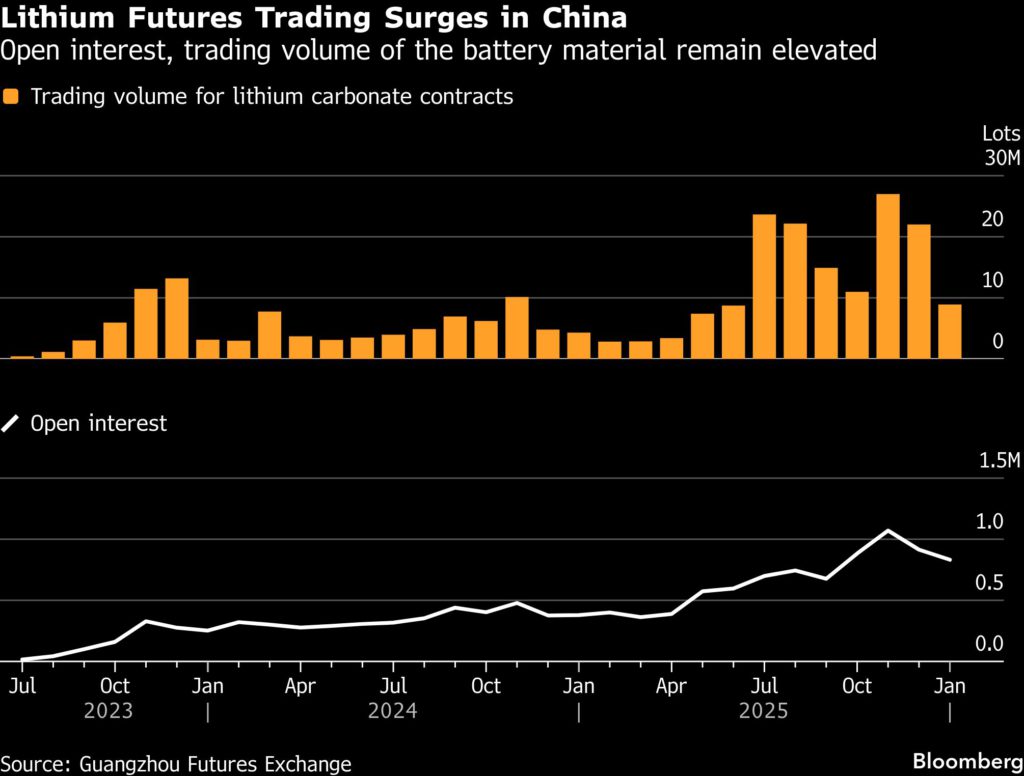

It’s the sixth time Guangzhou has stepped in since Dec. 19. Its previous interventions involved capping new positions and raising fees to quell the moves. Still, open interest and trading volumes have remained elevated, following the records hit in November.

The lithium market isn’t a stranger to turmoil, but expectations of ballooning demand for batteries, combined with anxieties over supply, have spurred extreme swings more regularly on the exchange.

“There have been more uncertain factors driving lithium carbonate futures recently, leading to heightened price volatility and increased market attention,” a spokesperson for the bourse said.

The most-active contract extended gains by about 7% to 166,740 yuan ($23,943) a ton on Wednesday afternoon. Prices have doubled since the start of November, propelled by bets on growth in energy storage systems, an uncertain supply outlook in one of China’s main production hubs, and the potential front-loading of the country’s battery-related exports in the first quarter.

Lithium producers’ shares surged on Wednesday, with Chengxin Lithium Group rallying 10%, while Tianqi Lithium Corp. and Ganfeng Lithium Group Co. gained more than 3%.

The breakneck expansion in battery metals means market reactions can be outsized on even hints that supply and demand may be shifting. Chinese market watchdogs typically step in when they believe moves are getting out of control.

Guangzhou was also among the exchanges that ordered local brokers this month to remove servers operated by high-frequency traders, a measure led by regulators to quash rapid-fire trading.

But lithium has also been caught up in broader enthusiasm for metals, from copper to silver and gold, which have roared higher in recent weeks as Chinese investors bet on global supply tightness, more favorable interest rates and heightened geopolitical risk.

“Going forward, we will closely monitor the lithium futures and spot markets, strengthen research and forecasting, and implement targeted risk-control measures based on market conditions to maintain the effective functioning of the futures market,” Guangzhou’s spokesperson said.

(By Annie Lee)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments