Chinese copper plants buy the dip after weeks out of market

Chinese copper fabricators and manufacturers are buying the dip to replenish stocks ahead of this month’s holiday, after a price surge driven by speculative trading in Shanghai kept them away from real-world purchases for weeks.

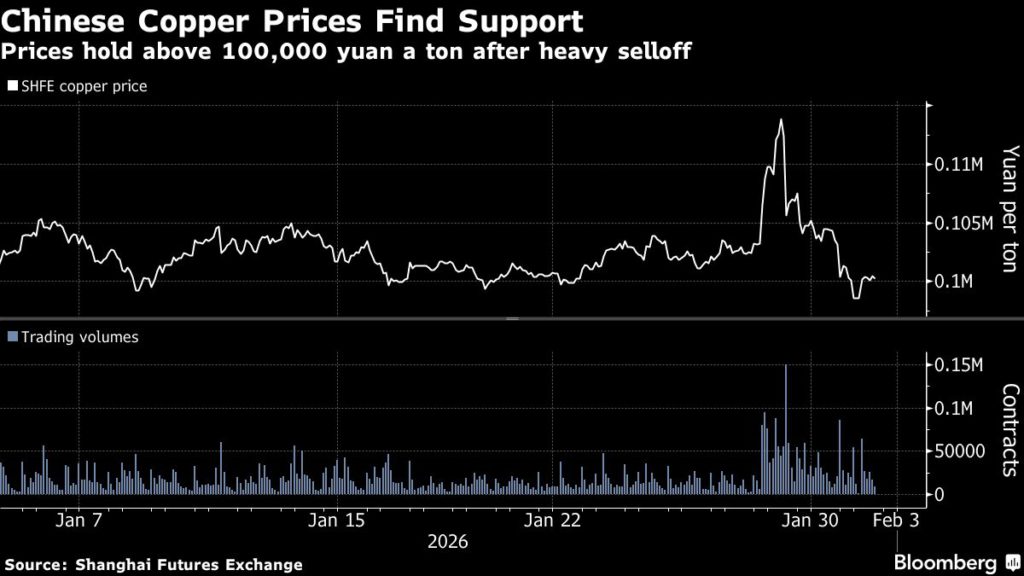

With futures down 12% from last week’s peak, some will continue to buy hand-to-mouth to meet their post-Lunar New Year production needs, so long as prices remain around the current level of 100,000 yuan ($14,400) a ton, people familiar with the matter said, asking not to be named discussing private deliberations.

Chinese plants that process copper into wires, cables and rods for use in power infrastructure, home appliances and electric vehicles are the world’s biggest consumers of the metal. Their buying could set a floor for prices, as it reflects an acceptable level for traditional users after assessing their outlook for future orders, rising costs and liquidity in the face of massive price swings.

Copper, gold, silver and other metals surged in January as bullish Chinese investors piled into commodities, driven by doubts about the dollar and a shift away from currencies and sovereign bonds. The rally fizzled abruptly at the end of last week as the greenback recovered and US President Donald Trump nominated a known inflation fighter to lead the Federal Reserve.

For copper, the frenzy in futures trading was a stark contrast to a slow physical market, with fabricators staying on the sidelines. Over the weekend, talk of dip-buying in China filled chat groups and social media, with analysts not ruling out another swing higher.

Trading volumes spiked on the Shanghai Futures Exchange when the front-month copper contract dipped below 100,000 yuan per ton, trading as low as 98,580 yuan on Monday. January was the busiest month ever for metals trading on the exchange.

The dip triggered a wave of buying on the physical market, with daily volumes doubling to 38,100 tons, the highest in three months, according to China-based commodities consultancy Mysteel.

More imported copper arrivals are also expected with prices on the London Metal Exchange, the global benchmark, trading lower and making it profitable to bring metal into China. LME copper futures have slumped below $13,000 a ton after jumping past $14,500 for the first time ever on Thursday.

Futures in London were down 1.3% to $12,899.50 a ton as of 4:53 p.m. local time.

(By Julian Luk)

More News

Pentagon strikes deal with Canada’s 5N Plus

February 02, 2026 | 11:36 am

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments