Green gold rush: investing in the metals and minerals powering the EV and solar boom

Last week, the Biden administration proposed aggressive new tailpipe emissions standards that, if enforced, would leave carmakers with no other choice than to produce electric vehicles (EVs) almost exclusively by 2032.

Under the proposal, among the toughest in the world, carbon dioxide emissions from new cars and light trucks would need to be reduced an ambitious 56% in less than 10 years. It’s believed that to meet this goal, two out of every three passenger vehicles manufactured in the U.S. would need to be electric models.

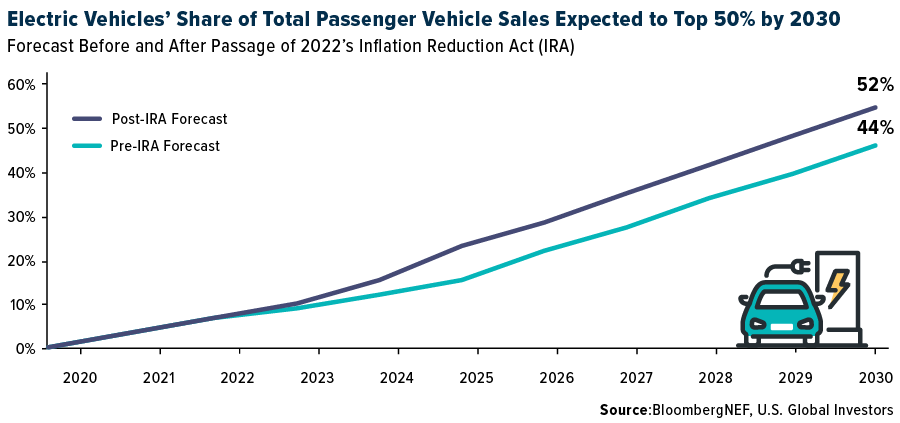

That’s a tall order. Today, EVs represent around 8% of total auto sales in the U.S. By the end of the decade, they’re forecast to account for a little over half of all sales. That’s up from an earlier forecast of 44% due to last year’s passage of the Inflation Reduction Act (IRA), but it’s still well below the 66%-67% that the administration’s proposal mandates.

As I’ve said many times before, government policy is a precursor to change, and if this proposal sticks, we may see some dramatic changes to our nation’s roads, power grids and charging stations in the coming years.

Profiting off the supply-demand imbalance

Many consumers and elected officials will very likely oppose the upcoming changes, but investors—particularly metals and mining investors—could be looking at a once-in-a-generation investment opportunity.

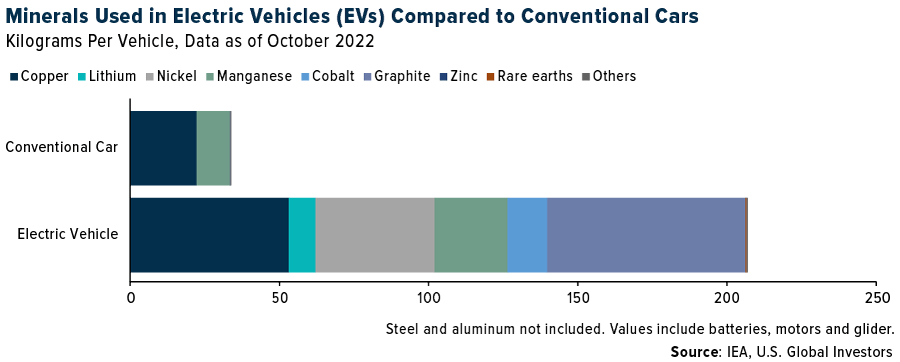

Compared to traditional internal combustion engine (ICE) vehicles, EVs require a vastly greater number and greater amounts of key materials. Based on the latest figures from the International Energy Agency (IEA), a typical electric vehicle—including its battery—contains 207 kilograms of minerals, or six times the amount in a conventional car. There’s roughly two and a half times as much copper, and more than twice as much manganese. EVs also require lithium, nickel, cobalt, graphite and rare earths—minerals which aren’t typically found in traditional vehicles.

Acquiring sufficient amounts of these materials to electrify America’s fleet of light cars and trucks will prove to be the greatest test of our commitment to the energy transition. It may pose an even greater challenge than the need to build out the U.S. power grid, manufacture enough batteries and install enough charging stations.

Supply-demand imbalances are a headache for manufacturers and can drive up prices for consumers, but for investors, they can be highly profitable. I recommend investors consider getting exposure to mining companies that produce the metals and minerals that will increase in demand as EVs steadily replace conventional vehicles—copper, lithium, nickel and cobalt in particular.

Silver is breaking out

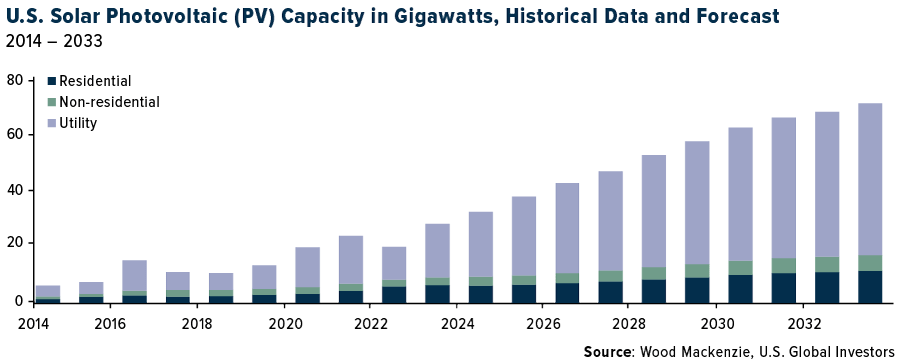

And then there’s silver. Although the white metal isn’t used in the production of EVs, it can be found in solar photovoltaic (PV) cells, which we’ll also be seeing more of in the coming years due to the energy transition.

Last year, solar power accounted for half of all new electricity-generating capacity in the U.S., marking the fourth straight year that solar beat other power sources in terms of added capacity, according to a report by Wood Mackenzie. The firm estimates that by 2033, cumulative U.S. solar installations will stand at 700 gigawatts, five times more than the 141 gigawatts of solar capacity today.

Like EVs, new solar installations will require vast amounts of metals and minerals, silver in particular. In fact, a study published late last year predicts that, by the year 2050, approximately 85%-98% of current global silver reserves will be consumed by the solar panel industry, creating a “significant silver demand risk.”

Again, today’s investors could be in a position to capitalize on tomorrow’s supply-demand imbalances by getting exposure to physical silver and silver miners.

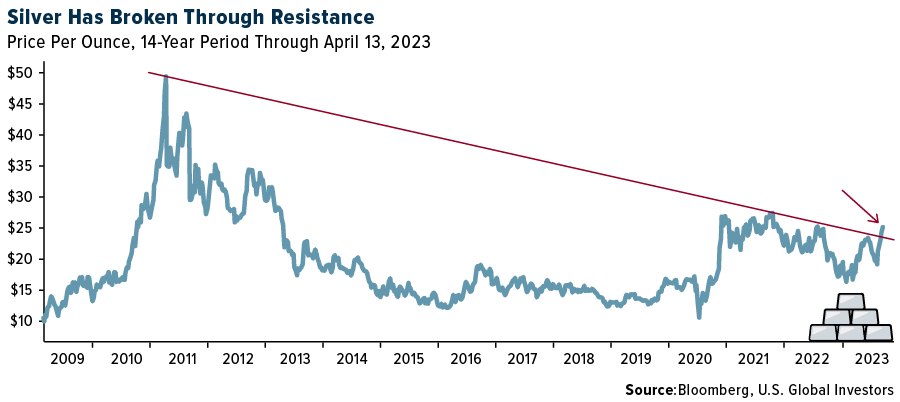

In the short term, silver looks very attractive on a technical basis, having just broken through strong resistance going back to 2011, when it hit its all-time high of $49 per ounce. Today the metal is trading at roughly half that price, so it still has a long way to go, but last week’s price action is constructive.

The 14-day relative strength index (RSI) shows that silver is extremely overbought, and we saw some profit-taking on Friday, pushing the metal down as much as 2.5% at its low. Some investors may consider buying these dips.

(By Frank Holmes)

More News

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments

Shehbaz Ahmad

I have big deposit of copper I can supply good quantity per month please anybody looking for good supplier recommende thank you