Japan boosts deep-sea mining plan to cut rare earth reliance

Japan is accelerating a decade-old plan to extract rare earths from the deep seabed, an ambitious initiative given extra impetus by the country’s drive to cut reliance on Chinese supply.

A state-owned vessel is scheduled to return to port this month after fitting equipment below the surface of Japanese waters, near a coral atoll 2,000 kilometers (1,243 miles) from Tokyo. The aim is to pull metal-bearing mud from the seabed for tests as early as February 2027, according to the government body running the project.

“It’s about economic security,” said Shoichi Ishii, program director for Japan’s National Platform for Innovative Ocean Developments. “The country needs to secure a supply chain of rare earths. However expensive they may be, the industry needs them.”

Rare earths — a set of metallic elements used in smartphones, electric vehicles and fighter jets — have become a political flashpoint, with China using its dominance of the global supply chain as a crucial bargaining chip in last year’s trade war with the US. More recently, Beijing banned exports to Japan of products destined for use in military applications, marking an escalation of a diplomatic spat between the countries.

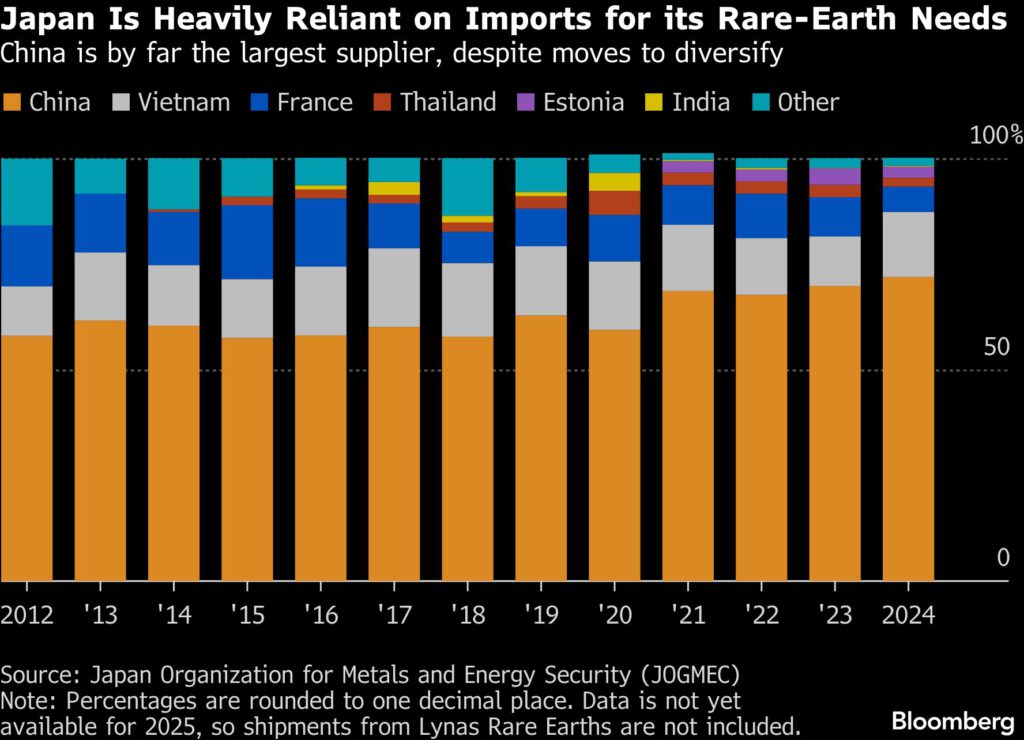

This is an issue for Japan. Despite spending heavily on securing alternative supplies — from investing in a separation facility in France to long-term financial backing for Australian miner Lynas Rare Earths Ltd. — the country still imports roughly 70% of its rare earths from China.

Mining the seabed will not solve this problem any time soon. Even if tests were to reveal a promising resource, cost and logistics would present major challenges to any potential developer. Large-scale commercial mining of metals from the seabed has never been achieved, despite widespread exploration.

The US — which hasn’t ratified a United Nations treaty that regulates deep-seabed mining in international waters — has moved to accelerate the approval process after President Donald Trump last year signed an executive order “unleashing America’s Offshore Critical Minerals and Resources.” But the latest changes are likely to raise concerns globally, with the International Seabed Authority now finalizing its own rules governing environmental safeguards.

Japan’s project, however, lies within its own territorial waters – near Minamitori Island, which marks the country’s easternmost point. According to the Cabinet Office, the cross-ministerial body responsible for deep-sea mining, around 350 tons per day of mud will be brought to the surface from a depth of between 5 and 6 kilometers.

This will be tested to see which rare earths are present and in what quantities, said Tadanori Sasaki, a senior research director at the Institute of Energy Economics. What happens next will depend on these results.

The deep-sea drilling vessel — named Chikyu — succeeded in recovering mud samples containing rare earths during its voyage to lay the equipment, Deputy Chief Cabinet Secretary Masanao Ozaki said at a regular media conference on Monday. “This test was intended to confirm, for the first time, whether it would be possible to continuously lift rare‑earth mud,” he said.

Japan, prompted by disruptions to global cobalt supplies, was one of a number of nations to begin exploring the sea for minerals in the late-1970s. The Japan Organization for Metals and Energy Security, better known as Jogmec, conducted a successful excavation test of a cobalt-rich crust on the seabed in 2020.

The rare earth project began in 2014 and moved through further phases before the ship, operated by the Japan Agency for Marine Earth-Science and Technology, set sail from the port of Shizuoka in January.

The initiative “seems to come up over the years, usually when China is raising concerns about rare earth exports,” said David Abraham, an affiliate professor at Boise State University in Idaho. “Sucking up mud below the surface, miles down in the dark with tremendous pressure, has the hallmark of outsized operating costs that will need consistent government support even if it’s feasible technically.”

For Ishii of the ocean development platform, cost is not a consideration. Asked about the commercial prospects of seabed mining, he said the Japanese government’s mission was to ensure a stable metals supply chain for its domestic industry. He drew a parallel with the US government’s recent $400 million investment in MP Materials Corp., a company that revived a dormant rare earth mine in California – on land, not at sea – with the aim of securing supply.

Market conditions “are favorable for Japan as it looks to advance testing and development of the unconventional deposit,” said James Tekune, research associate at consultancy Adamas Intelligence. But he remained cautious about the prospects for deep-sea mining in general as a future source of rare earths. “At best, it will emerge as a niche supply stream,” he said.

(By Yusuke Maekawa and Annie Lee)

More News

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments