Metals frenzy gets painful gut check just as YOLO crowd piles in

The red-hot trade in metals and mining stocks is crumbling just as droves of individual investors began piling in.

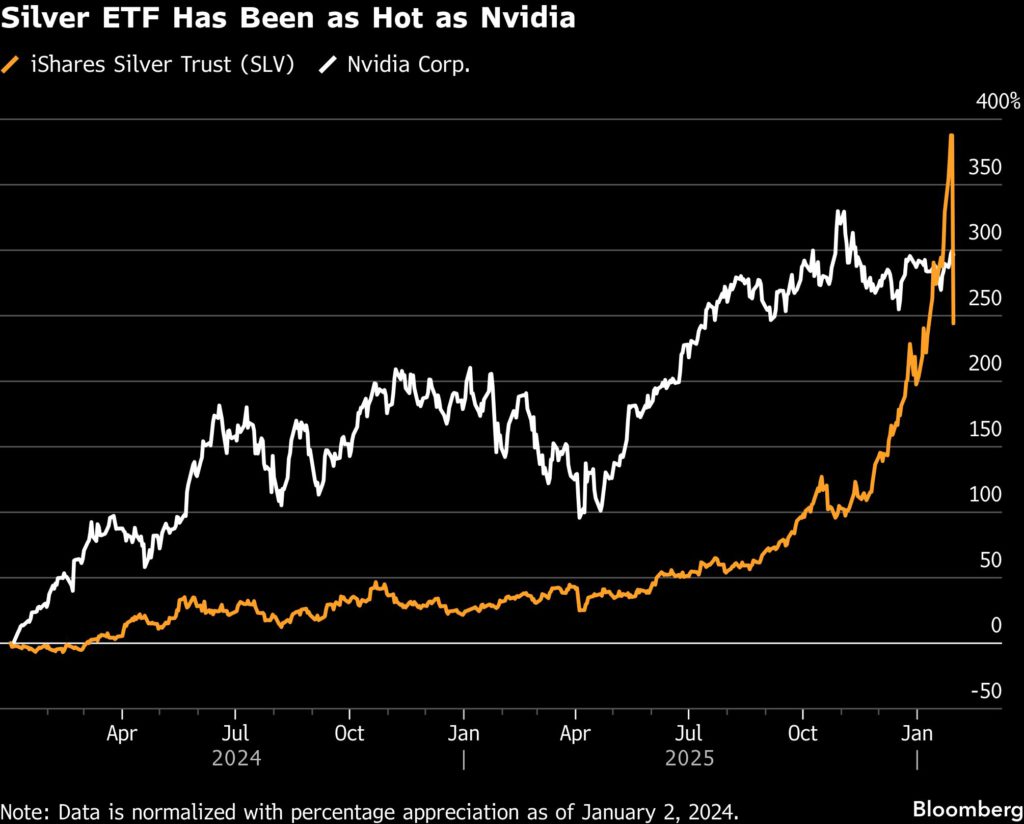

Gold, silver and copper prices plunged on Friday, triggered in part by a rebound in the US dollar. The tumble, which halted a furious rally that lifted prices to all-time highs, came the day after retail traders funneled roughly $171 million into the iShares Silver Trust (SLV), which tracks the metal’s price, figures from Vanda Research show. It was the largest one-day net inflow on record from that group.

That fund slumped the most since its 2006 debut on Friday, while the NYSE Arca Gold Miners Index saw its steepest drop since 2008. Materials was the weakest sector in the S&P 500 Index. The rout in precious metals continued Monday, with gold falling as much as 10%. At one point, silver plunged 16% before reversing some of the retreat.

Now the worry is that the increasing involvement of a potentially fickle group — individuals chasing a quick gain — may spur even wilder swings.

“Once a trade crosses from being a portfolio ballast into meme-stock territory, volatility rises,” said Dave Mazza, chief executive officer at Roundhill Investments. “Everyone went all in quickly, so when the mood shifts, everyone moves at the same time, causing a negative and forceful feedback loop.”

President Donald Trump’s nomination of Kevin Warsh, seen as a relatively hawkish choice, as the next Federal Reserve chair was a catalyst for Friday’s moves. On Friday, the greenback gained the most since May, gold fell 9% and silver declined more than 20%.

Precious metals, which are priced in dollars, had soared in recent weeks as a stretch of dollar weakness, heightened geopolitical tension and increased industrial demand for silver in technology boosted their appeal. Also, with some of the Big Tech stocks stalling this year, speculative capital from the retail crowd eying the metals mania further propelled the momentum.

Active bunch

In a sign of growing retail involvement, the SLV fund was the fifth-most active symbol across equities and options on Interactive Brokers for the five days to Jan. 27, around twice its stature the prior week. By Friday, it was the second-most active, said Steve Sosnick, chief strategist at the firm.

The group’s participation in the gold and metals trade “just creates more volatility,” said Christopher Harvey, head of equity and portfolio strategy at CIBC Capital markets. “It’ll drive some folks crazy and make others happy.”

At Jefferies LLC, equity strategist Steven DeSanctis said in a Jan. 29 note that a “new twist” emerged in the firm’s basket of retail-favorite stocks: eight names from the metals and mining sector.

Alexander Altmann at Barclays Plc saw an opening in Friday’s selloff — the chance to get into industrial metals, which got caught up in the turmoil. Catalysts for that segment include the buildout of AI infrastructure and fiscal expansion by many governments that could help lift prices.

The Bloomberg Industrial Metals Subindex, or BCOMIN Index, has surged some 30% from recent lows, while during metal rallies since the 1990s, the average move was roughly 170% trough to peak, according to Barclays.

The spillover into the broader metals space “is a gift, in my view, and a dip that is worth stepping into,” said Altmann, global head of equities tactical strategies at the bank.

“Importantly, it is the underperformance of industrial metal stocks relative to precious metal companies — where retail have mostly been crowded into — that makes the trade particularly interesting,” Altmann said.

(By Alexandra Semenova)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments