Options traders bet gold price to rally more after breaking $5,000

Options traders are betting on a further rally in gold prices after the precious metal smashed through $5,000 an ounce for the first time ever.

Bullion surged 2.5% to top $5,100 in a broad metals rally that’s fueled partly by the reopening of the so-called debasement trade, as investors shied away from sovereign bonds and currencies and moved into hard assets such as gold and silver. As President Donald Trump continues to challenge the post World War II rule-based order, investors are expected to keep diversifying away from US assets.

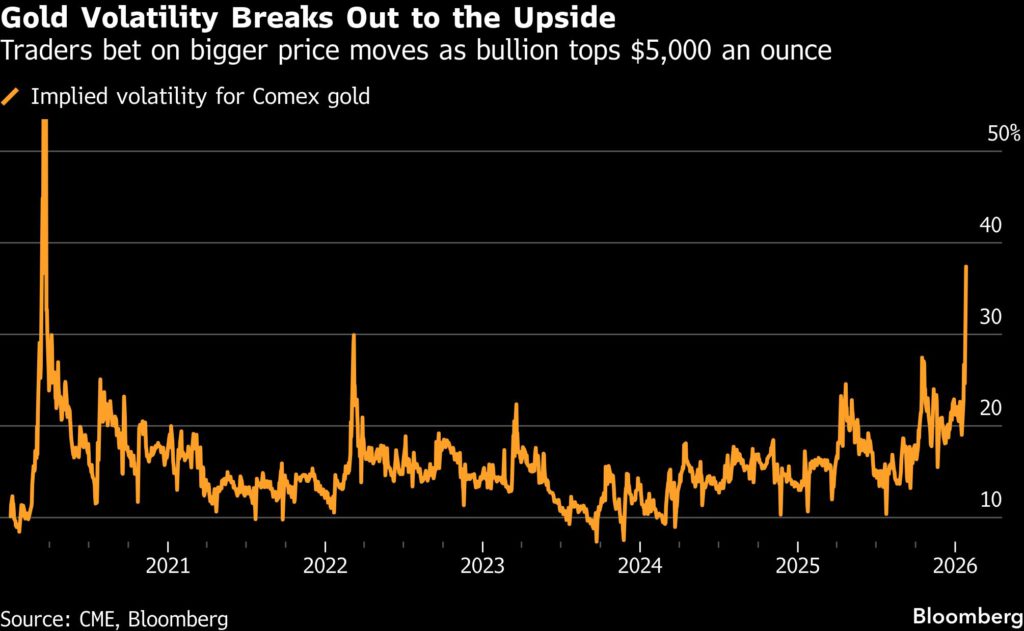

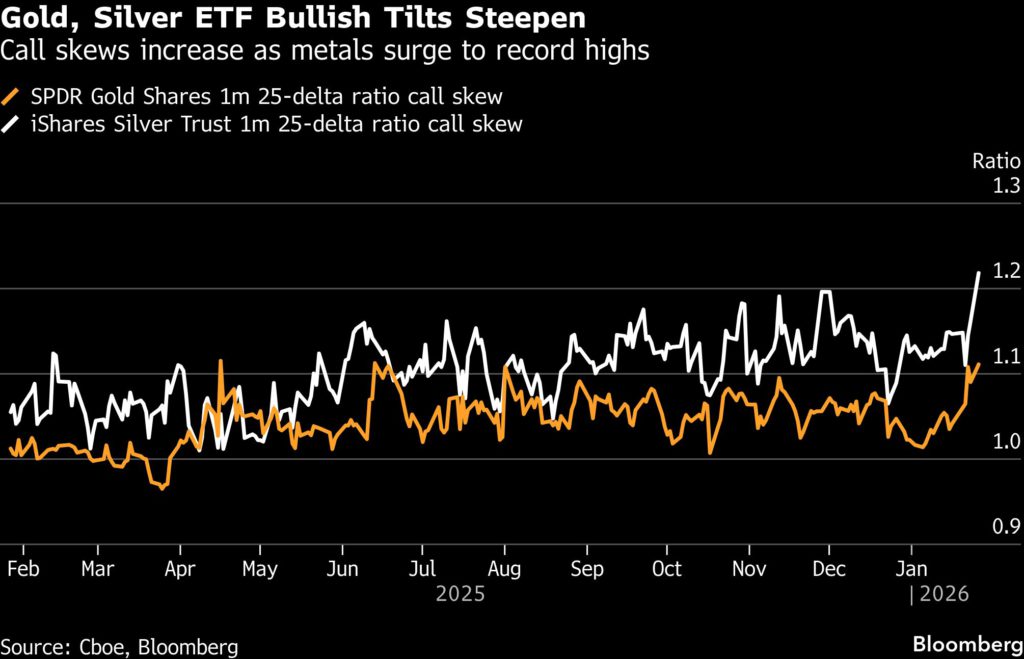

Implied volatility of Comex gold futures climbed to the highest since March 2020, the peak of the pandemic, while volatility on State Street’s SPDR Gold Shares (GLD) — the world’s largest gold exchange-traded fund — has broken out higher with traders betting on a very large price increase.

Options trading volume was heavy in call spreads, with April Comex $5,550/$5,600 spreads trading almost 5,000 lots, and April $5,500/$6,000/$6,500 1x3x2 strategies changing hands 1,000 times.

As prices approach key strike levels, traders are rolling positions higher. Market makers who are short calls may need to buy more futures to balance their exposure as the market rallies, which could generate a gamma-driven squeeze and drive prices even higher.

Investors snapped up call spreads in in SPDR Gold Shares. They bought about 70,000 Sept. $590/$595 and 37,000 March $510/$515 spreads to put on relatively inexpensive bets on further gains in coming months.

The March position, for example, would pay out as much as 4.2 to 1 if the ETF rallies a further 10.1%, according to strategists at Susquehanna International Group.

Of the $4.7 billion of inflows across the US listed gold ETF sector in January, more than half has flowed to GLD, according to Aakash Doshi, global head of gold/metals strategy at State Street Investment Management.

“This likely reflects strong institutional flows and active dealer longs in the space as markets were targeting $5,000,” said Doshi. “With elevated geopolitical uncertainty and structural factors supporting gold from 2025 intact, and now followed on with the US dollar depreciation, we think call spread activity reflects investor demand for further topside in gold.”

In silver, volatility and the call skew — or premium for bullish options — also spiked. iShares Silver Trust (SLV) May $125 calls traded more than 35,000 lots, while on Comex 200 lots of April $110/$120/$130/$140 condors traded.

(By Yvonne Yue Li and David Marino)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments