US mineral supply chains remain exposed to China chokehold: USGS report

A new report by the US Geological Survey reveals that the United States has grown more reliant on foreign imports of minerals over the past year, highlighting the increased urgency to bolster its domestic supply chains.

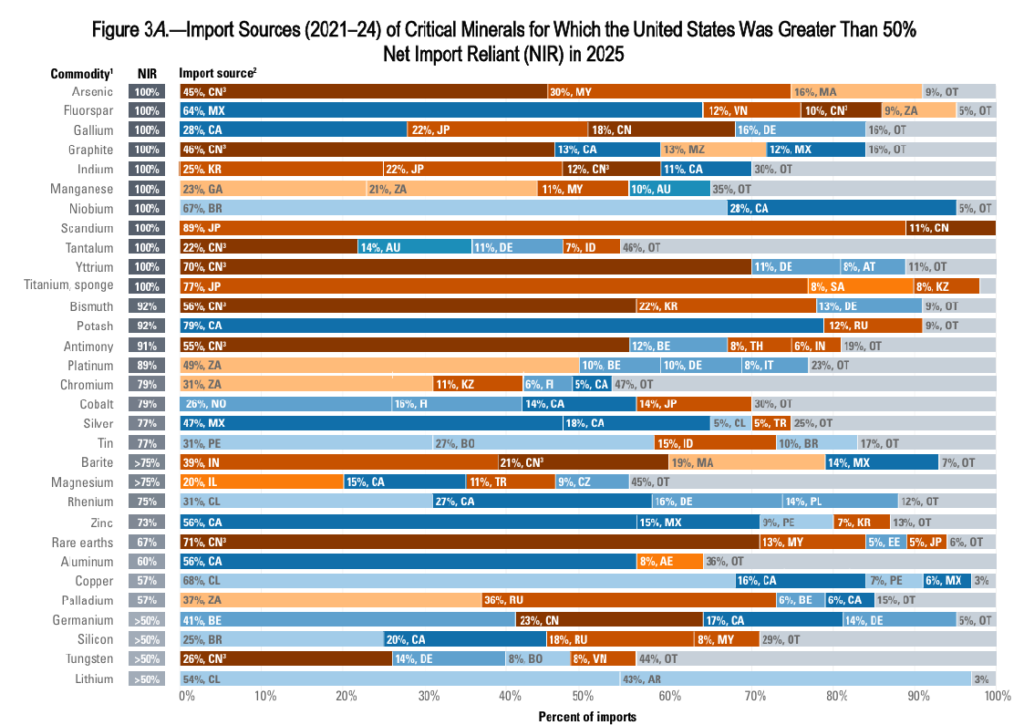

In its annual mineral commodities summary published on Friday, the USGS found that the country was 100% import reliant last year for 16 out of the 90 non-fuel commodities that it tracked. In addition, the US relied more than one-half of its apparent consumption for 54 of the minerals, the report showed.

In comparison, the 2024 data showed 100% import reliance for 15 commodities and more than one-half import reliant for 46 minerals, the USGS said.

As highlighted in the report, the United States is totally reliant on its imports of arsenic (all forms), asbestos, cesium, fluorspar, gallium, graphite (natural), indium, manganese, mica (natural), niobium (columbium), rubidium, scandium, strontium, tantalum, titanium (sponge metal) and yttrium. Most of these are on the USGS critical minerals list, with asbestos, mica and strontium being the only absentees.

An additional 20 critical minerals had a net import reliance of greater than 50%, down from 28 in 2024, USGS noted.

China’s chokehold

For many of the USGS critical minerals, China features prominently as a key supply source, accounting for nearly half of its arsenic and graphite imports, 55% of its antimony, and 70% of rare earths.

“This report underscores just how hard it is to put a dent in China’s decades-long strategy to dominate the world’s minerals markets,” said Rich Nolan, president and CEO of the National Mining Association (NMA), in a press release.

Another leading source of critical minerals is Canada, which supplies the aluminum, gallium, potash and zinc to the US. For copper and silver, which were recently added to the USGS list, Chile and Mexico were the leading import sources respectively.

The USGS report comes at a time when the US government is intensifying efforts to establish a critical minerals supply chain that is independent of China. Earlier this week, the Trump administration unveiled plans for a $12 billion stockpile of critical minerals. Vice President JD Vance followed that up by announcing plans to marshal allies into a preferential trade bloc for critical minerals.

“We have an administration and Congress that have united around the need to de-risk our supply chains and reshore minerals production and processing, but it still takes an average of 29 years to bring a mine online in the US,” Nolan said.

“That’s far too long. Quick action by the administration has been key in jumpstarting domestic mining efforts but we need Congress to act on permitting reform to create the kind of lasting certainty that mining companies need in order to make long-term investments in US projects.”

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments